You may already know that switching to solar energy can both decrease your energy bills and decrease pollution, but did you know you can also save on your solar installation? With current tax credits and incentives for the 2023 year, there are a number of ways to save when you switch to renewable energy, whether that’s with solar, energy storage, or electric vehicle charging.

As some renewable energy incentives can change from year to year, we’ve complied a list of current savings opportunities for the 2023 year. To inquire about eligibility for this year’s tax credits, please consult your tax advisor or accountant for further information.

Residential Solar Tax Credits

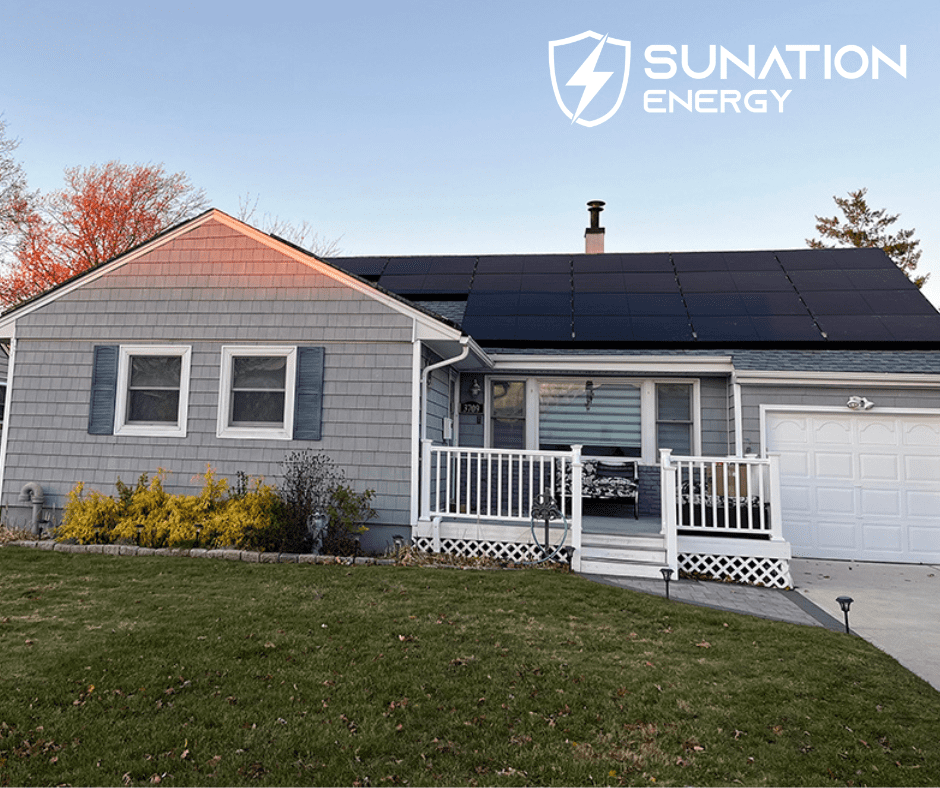

This is the perfect time for residential solar installations on Long Island. With both Federal and State tax credits available, homeowners have the opportunity to take advantage of both for maximum savings.

2023 Federal Tax Credit: Thanks to the Inflation Reduction Act of 2022, home solar installations which take place between now through 2032 may qualify for a 30% tax credit. This is only for owned solar panel systems, not leases or PPAs. Starting in 2033, the tax credit is set to decrease to 26% and then decrease again in 2034 to 22%.

2023 New York Tax Credit: In addition, solar installations may qualify for a 25% New York State tax credit up to $5,000. To qualify, homes must be in New York and be owned. If you rent your home, unfortunately you will not qualify. The homeowner must also be a resident of New York.

Tax Credits for Energy Storage Batteries

After solar energy, there are even more ways to save both money and the environment with backup energy storage batteries. Unlike gas generators, which are loud, create pollution, require a manual start and monitoring, and can be dangerous, today’s energy batteries still provide that energy security in a quiet, safe, and seamless way.

There are two ways you can get your storage battery, packaged with a solar installation or on its own as a stand-alone battery.

New To 2023! Previously, the only way to apply any tax credits to a solar energy storage battery was when it was combined with a solar panel installation. This year, beginning January 1, 2023, stand-alone solar batteries now also qualify for a 30% tax credit of the cost for the battery. To qualify, batteries must be over three kilowatt-hours.

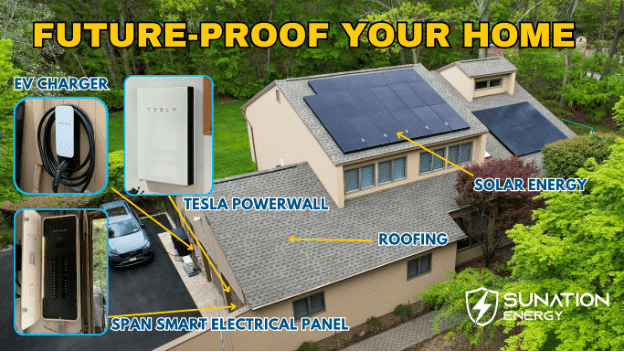

EV Charger Tax Credits

With today’s rising gasoline prices, switching to an electric vehicle, and being able to power your vehicle from home, is not only good for the environment, but can also save drivers in the long run. With a home EV charger, drivers can also charge their vehicle with the clean, renewable energy they generate from their solar panels.

Like the stand-alone energy batteries, this year provides new opportunities tax credits for EV chargers.

New to 2023! Beginning January 1, 2023fueling equipment for electric power for vehicles, like Level 2 EV Chargers, qualify for a 30% tax credit up to $1,000 for residential homes.

Local EV Rebates: As of February 2023, there are currently no rebates for EV chargers by either PSEG or ConEdison. However, ConEdison has a waitlist for their SmartCharge New York program opening in “early 2023.”

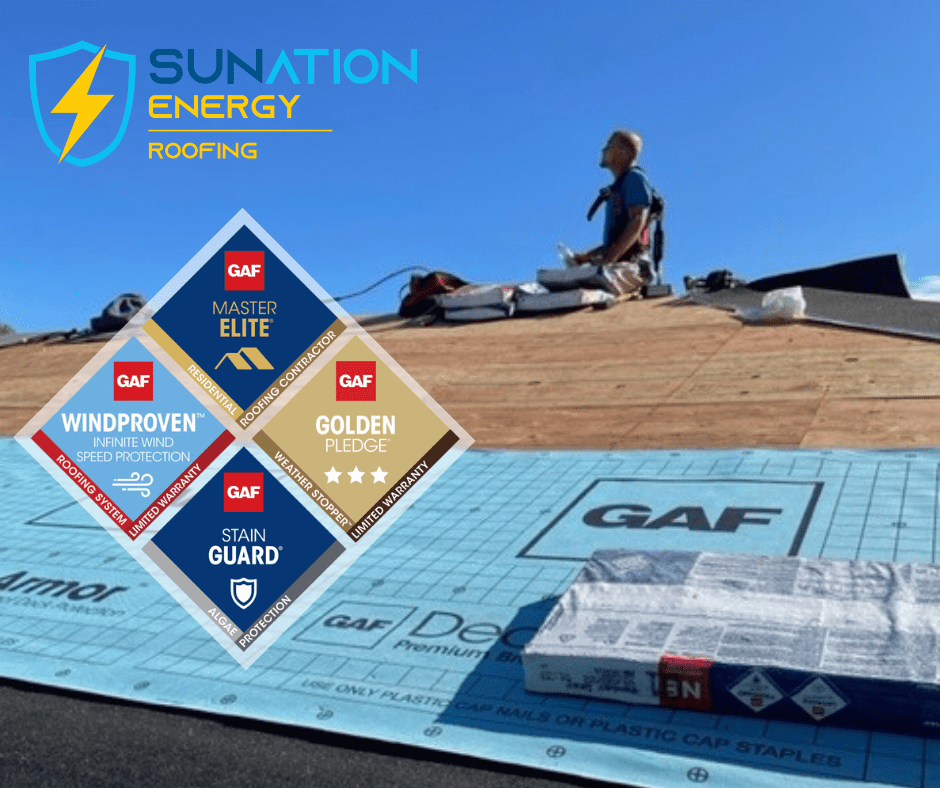

Save When You Switch To Renewable Energy

Making the switch to solar energy, backup energy storage batteries, or electric vehicle charging doesn’t have to break the bank. Discover what you can save with current incentives, and how low your monthly energy bills can go, with the friendly team at SUNation Energy.

Call today at 631-750-9454 or contact us online for a customized quote and a no-pressure consultation.