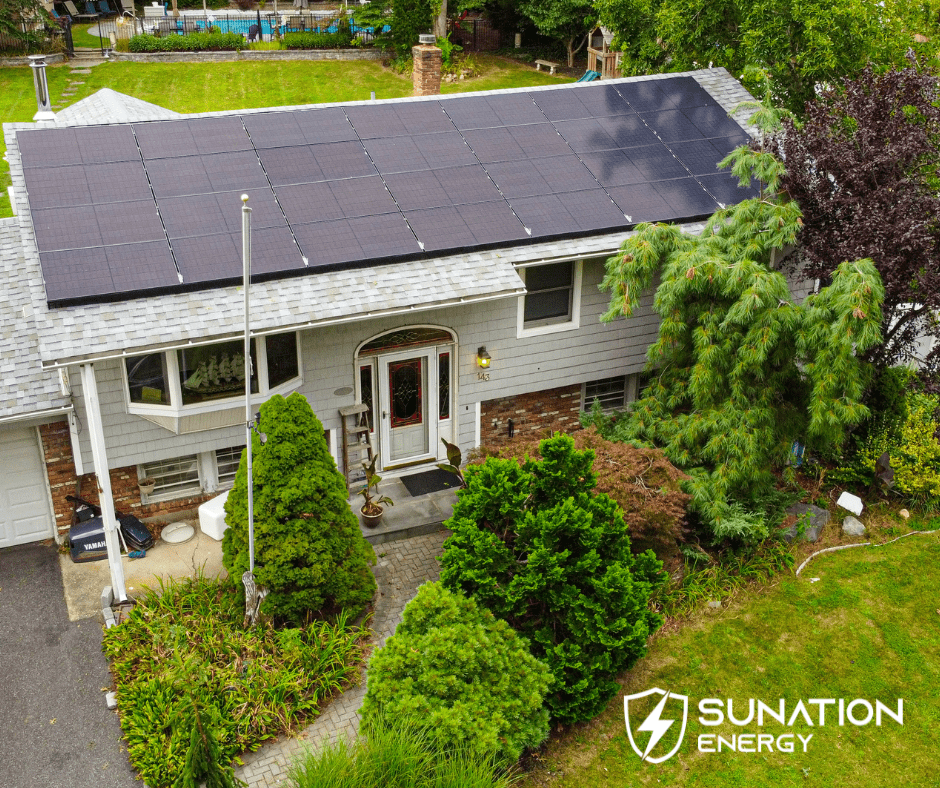

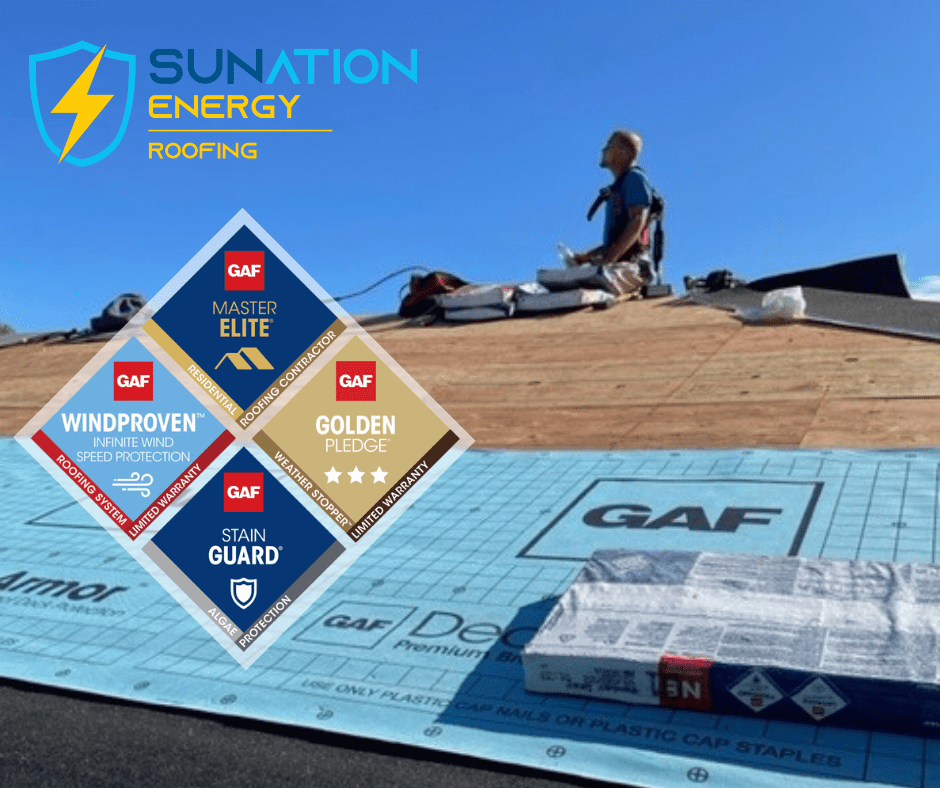

One of the biggest opportunities to save on your Long Island solar installation is now getting an upgrade through the Inflation Reduction Act of 2022. For years homeowners have said the cost of switching to solar energy was the biggest hurdle they faced in upgrading their home to a more sustainable energy source. Thanks to solar tax credits, the cost to go solar in New York has never been lower.

Those who make the switch to solar energy can also expect to see monthly savings in lower electricity bills as their home relies less on the power grid and more on clean, renewable energy. The sooner homeowners take advantage of these money-saving solar opportunities, the more they can save.

What Are Solar Tax Credits?

Solar tax credits are incentives for getting a solar panel system that can help cover the costs of your installation. This can include the cost of the solar panels themselves, labor costs, permitting fees, additional hardware and more. In New York, homeowners can take advantage of the Investment Tax Credit (ITC), or Federal tax credit, and combine it with the New York State tax credit for maximum solar savings.

What Are The Current Residential Solar Tax Credits in New York?

Federal: Was 26%, now raising to 30% from 2022-2032 due to the Inflation Reduction Act

New York State: 25% on solar installations up to $5,000

The Future of Federal Solar Tax Credits

Up until recently, Federal solar tax credits were being held at 26% until the end of 2022 where they were expected to lower to 22% in 2023 and disappear altogether by 2024.

With the new incentives, the tax credit has gone back up to 30% and will remain there until the end of 2032. In 2033, the tax credits will go back down to 26% and drop again in 2034 to 22%.

What Residential Solar Installations Qualify in New York

Each tax credit has its own qualifications to really take advantage of these rates. Feel free to ask our SUNation team any questions you have about your specific home’s eligibility.

Federal: Only owned solar energy systems qualify. Those that are leased, part of a PPA, or power purchase agreement, or have a Community Solar subscription cannot take advantage of this tax credit.

New York State: This tax credit is available for purchased homes in the state of New York. Similar to the Federal tax credit, if you rent your home, you cannot claim the tax credit. You must also a resident of New York and have a tax liability in the state.

Consult your tax professional regarding your specific tax credit eligibility. SUNation does not give tax advice nor do we guarantee tax benefits.

The Solar Savings Continue

After using your solar tax credits, the savings can still continue once your solar panel system is operating. By going solar, you’ll be relying less on the power grid with your own renewable energy. This in turn will lower your monthly electricity bills, and in some cases eliminate them altogether.

SUNation Energy is now saving New Yorkers an estimated $20 Million annually in energy savings, and with the cost of energy on the rise, it’s never been more important to take control of your electricity expenses.

Additional Tax Credit Opportunities

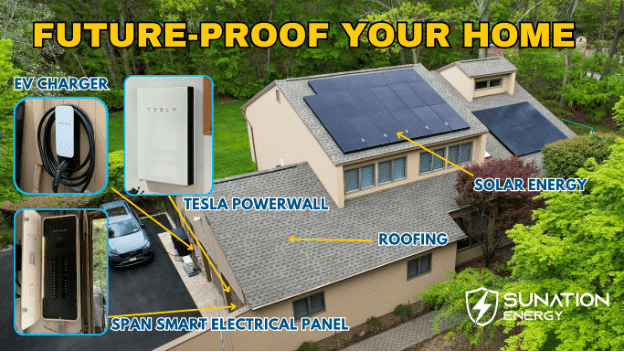

Battery Storage Systems

Those looking to backup their sustainable electricity with an energy storage battery can take advantage of Federal tax credits as well. For standalone batteries, purchases made after December 31, 2022 that are over 3 kWh will also be eligible for the 30% tax credit as per the Inflation Reduction Act.

EV Chargers

If you already have an electric vehicle, or are looking to get one in the future, SUNation offers EV chargers that qualify for current tax credits of 30% as well. Level 2 chargers like JuiceBox and ChargePoint from our SUNation Service Department can qualify for a $400 rebate from PSEGLI for any purchases from August 1, 2022. For Con Edison customers, you may qualify for a $150 enrollment reward for your first charge in Con Edison territory.