With some of the highest electricity rates in the country, New York has found innovative ways for homeowners who use sustainable energy to save money. One of these incentives is called the New York Solar Equipment Tax Credit. Currently, homeowners with taxable income are entitled to a 30%Federal Tax Credit (no cap) and a 25% State Tax Credit (capped at $5000). However, over the next few years, the Federal Tax Credit is expected to decrease dramatically. But it’s not too late to get a solar system for your home and reap the remaining financial benefits.

How Is Solar Energy Beneficial?

Solar energy is the cleanest and most abundant renewable energy source available, and the U.S. has some of the richest solar resources in the world. Solar technologies can harness this energy for a variety of uses, including generating electricity, providing light or a comfortable interior environment, and heating water for domestic, commercial, or industrial use.

Because solar energy creates clean, renewable power from the sun, it reduces our carbon footprint and reduces greenhouse gases, making this an eco-conscious, or “green”, option for homeowners. Solar energy is also free and readily abundant. By investing in solar energy, you can help reduce your reliance on fossil fuels in favor of one of the most abundant, consistent sources of energy we have available: the sun.

How much is the NY Solar Tax Credit and when can you claim it?

The New York State’s Tax Credit is equal to 25% of your solar costs or $5,000–whichever is lower. Because a tax credit can be subtracted directly from your tax bill, dollar-for-dollar, you can count this as pure savings. New York’s Solar Tax Credit is one of the most flexible in the country because you can “roll over” any excess credits for up to five years.

Who is eligible to claim the NY Solar Tax Credit?

You must meet the following criteria to be eligible for New York State’s Solar Equipment Tax Credit:

- You must be a New York State resident.

- You have had a solar energy system (used for heating, cooling, hot water, or electricity generation) installed on your primary residence in New York State.

- You have a tax liability in New York State.

- In the case that you went solar with a lease or power purchase agreement (PPA), that the term of your contract is at least 10 years.

What forms do you need to claim the New York Solar Tax Credit?

In order to claim the Solar Tax Credit, you will need to fill out form IT-255 when you file your taxes. You can find the latest version of form IT-255 here on Tax.NY.gov.

More Residential Incentives

There are other incentives available for New York homeowners who use renewable energy and solar including the following:

Just because some incentives will be changing in the next few years, it doesn’t mean there aren’t other options out there. Purchase a solar system and save money with NY incentives and tax credits while you can.

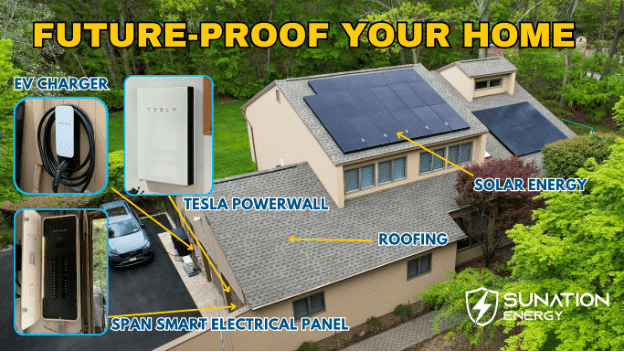

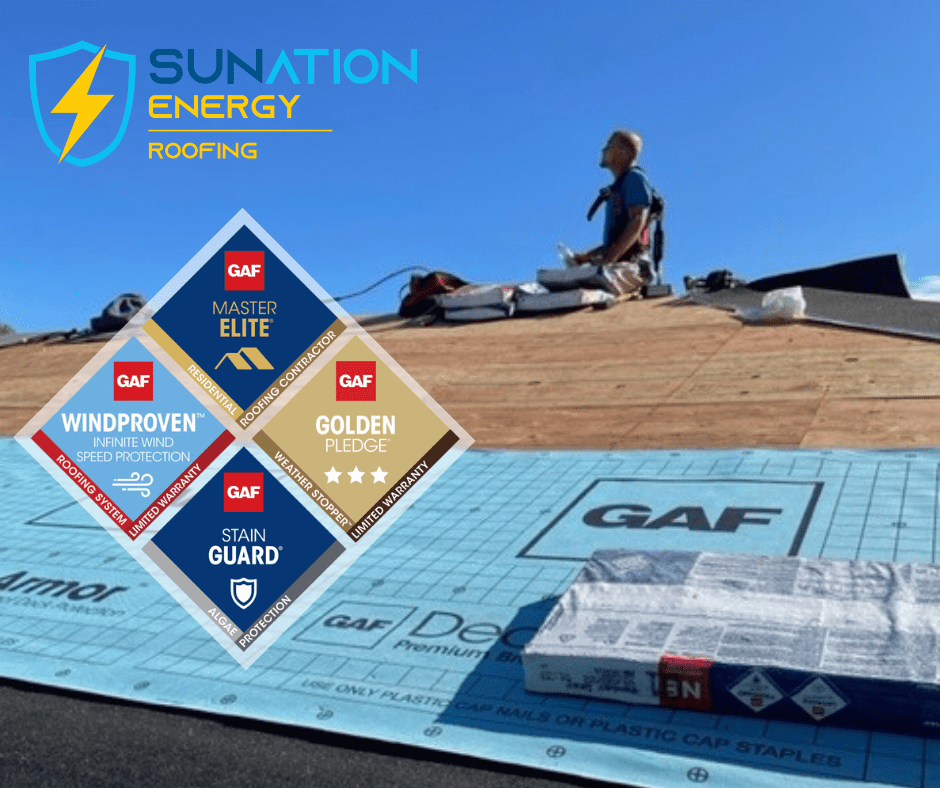

Where can I purchase a solar panel system?

SUNation Solar Systems is Long Island’s local solar expert with over 6,000 residential, commercial and municipal solar installations. Since 2003, SUNation has been professionally installing the highest quality and most durable solar panels and equipment. Call us today at 631-750-9454 to learn how you can save money with your own solar panel system.